Exploring IBVape Vape Shop Benefits and How Does Ends E-Cigarette Taxes Work for Smokers

Discovering the Advantages of IBVape Vape Shop and Understanding E-Cigarette Taxation

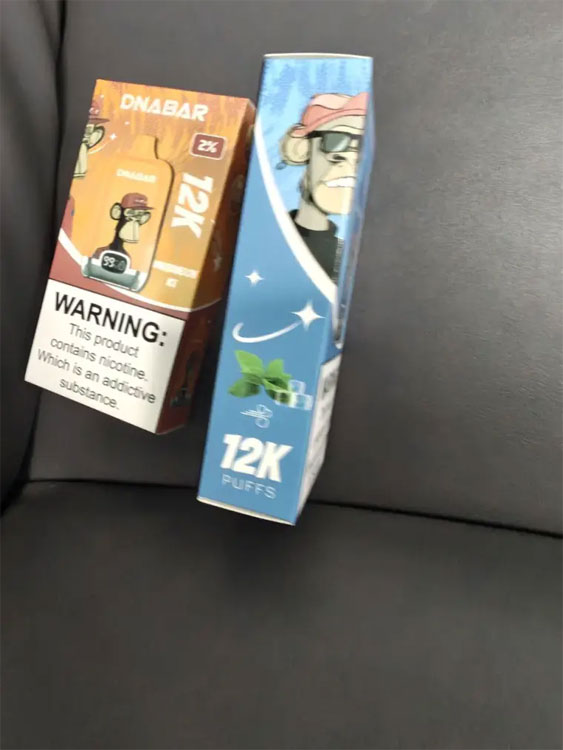

In today’s evolving vaping landscape, IBVape Vape Shop stands out as a premier destination for enthusiasts seeking quality products and comprehensive service. This vape retailer not only offers a diverse selection of e-liquids, vaping devices, and accessories but also prioritizes customer education about vaping and related policies. Such dedication is crucial, especially considering the complex nature of how does ends e-cigarette taxes work and their impact on consumers.

Why Choose IBVape Vape Shop ?

?

When exploring vaping options, IBVape Vape Shop delivers multiple benefits that enhance the vaping experience. First, their curated product portfolio ensures safety and satisfaction, featuring reputable brands and regulated ingredients. The shop’s knowledgeable staff assist users in selecting devices tailored to their needs, whether beginners or seasoned vapers.

Beyond product quality, IBVape Vape Shop provides vital community support through workshops and updates about regulatory changes, ensuring customers stay informed about taxation and legal shifts.

Demystifying the Mechanism Behind E-Cigarette Taxes

Understanding how does ends e-cigarette taxes work involves exploring the fiscal strategies governments employ to regulate vaping products. Taxation on e-cigarettes typically includes excise duties designed to discourage underage usage, offset healthcare costs, and control consumption rates.

These taxes vary geographically, depending on local legislation. They can be applied as a percentage of sales price, a fixed amount per unit, or through value-added tax (VAT). The end cost to consumers includes this tax burden, which can influence purchasing decisions significantly.Authorities often aim to balance public health goals with economic factors, making the taxation policies a dynamic subject worth monitoring.

The Impact of E-Cigarette Taxes on Smokers and Vapers

For smokers considering the switch to vaping, tax policies can either encourage or discourage this transition. Reasonable taxes help maintain e-cigarettes as an affordable alternative to traditional tobacco products. Conversely, high taxation might limit accessibility, ultimately affecting public health objectives.

Retailers like IBVape Vape Shop play a pivotal role by advocating transparent pricing and educating customers about these tax-related issues, empowering them to make informed choices.

Additionally, tax revenues often fund anti-smoking campaigns and support cessation initiatives, creating a multi-layered approach to tobacco control.

Strategies for Navigating E-Cigarette Taxes

Consumers and retailers alike benefit from understanding the practical aspects of how does ends e-cigarette taxes work. Staying informed about local tax rates, potential exemptions for certain products, and legal updates helps mitigate unexpected costs.

Many users leverage offers at establishments like IBVape Vape Shop, which may include discounts or loyalty programs to offset tax impacts. Moreover, abiding by regulations ensures long-term access to quality vaping products without legal or financial penalties.

Future Outlook on E-Cigarette Taxation

Governments continue to refine taxation policies as new data on vaping’s health effects emerge. Expert discussions suggest possible adjustments may focus on harmonizing tax rates with tobacco products to streamline regulations.

IBVape Vape Shop remains proactive in adapting to these changes, keeping customers well-informed and compliant with evolving laws.

Frequently Asked Questions

- How do e-cigarette taxes affect vaping product prices?

- Taxes increase the retail price of vaping products, which can impact affordability but may also fund public health initiatives.

- Does IBVape Vape Shop provide information on local tax laws?

- Yes, the shop actively educates customers about taxation policies and possible financial impacts on purchases.

- Are there exemptions available for certain e-cigarette products?

- Some jurisdictions offer exemptions for specific categories, such as medicinal vaping devices; staying updated with shops like IBVape Vape Shop helps in identifying these.

In conclusion, engaging with a trusted vendor like IBVape Vape Shop not only grants access to premium vaping products but also essential guidance on navigating the intricate how does ends e-cigarette taxes work framework, ensuring a satisfying and compliant vaping experience.